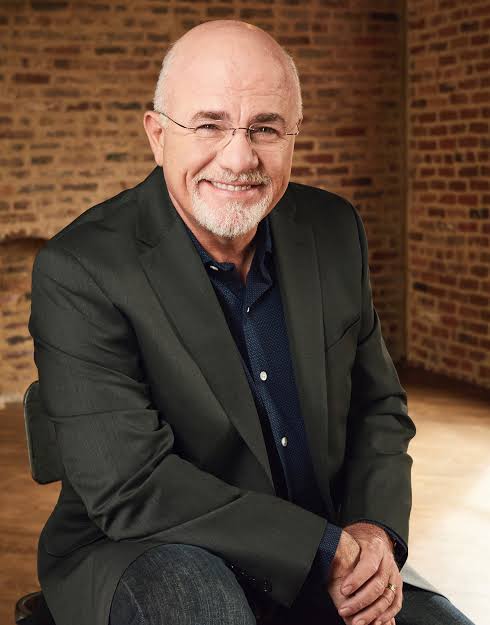

When it comes to personal finance, few names carry as much weight as Dave Ramsey. Known for his practical, no-nonsense advice, Ramsey has helped millions of people around the world take control of their money. His philosophy is built on discipline, intentionality, and living debt-free. If you’ve ever wondered how to simplify your finances and achieve financial freedom, this guide is for you. Today, we’ll break down 👌 So simple, so clever: 20 best Dave Ramsey tips done right!—a collection of strategies that work whether you’re just starting out or already on your wealth-building journey.1. Create a Written BudgetRamsey insists on a zero-based budget. Every dollar has a job, whether it’s for bills, savings, or fun.2. Build a Starter Emergency FundSave at least $1,000 as your first safety net before aggressively tackling debt.3. Pay Off Debt with the Debt SnowballList debts smallest to largest and pay them off in that order for motivation.4. Cut Up the Credit CardsRamsey’s firm stance: avoid credit cards and live on cash or debit to stop accumulating debt.5. Live Below Your MeansSkip the lifestyle creep. Spend less than you earn and focus on essentials.6. Save 3–6 Months of ExpensesOnce debt-free (except the mortgage), build a larger emergency fund to weather big storms.7. Avoid Car PaymentsBuy used cars with cash—don’t throw money away on depreciation and loans.8. Stop Borrowing MoneyStudent loans, personal loans, payday loans—Ramsey advises staying away from all of them.9. Build Wealth Through Retirement InvestingInvest 15% of your income in tax-advantaged accounts like 401(k)s and IRAs.10. Save for Kids’ College Without LoansUse Education Savings Accounts (ESA) or 529 plans if available.11. Pay Off the Mortgage EarlyImagine life without a house payment—Ramsey says it’s one of the keys to financial peace.12. Get Adequate InsuranceHealth, life, disability, auto, and home insurance protect your financial progress.13. Use Cash Envelopes for SpendingPhysically separating money into categories helps control overspending.14. Focus on Needs, Not WantsBefore purchasing, ask: is this a need or just a want?15. Give GenerouslyDave believes generosity is part of true wealth. Tithing or charitable giving should be part of your plan.16. Avoid Get-Rich-Quick SchemesStick with steady, proven investment strategies. No shortcuts.17. Increase Your Income if NeededSide hustles, career upgrades, or extra jobs can help speed up your journey.18. Teach Kids About Money EarlyRamsey encourages paying kids commissions (not allowances) so they learn work-money value.19. Stick to the Baby StepsHis 7 Baby Steps framework keeps you focused and motivated.20. Stay Motivated with the Debt-Free CommunityCelebrate milestones, listen to success stories, and stay encouraged by others on the same path.Practical Tips for Applying Ramsey’s AdviceTrack every dollar with budgeting apps or pen and paper.Celebrate small wins when debts are paid off.Stay accountable—share your goals with family or friends.Stay disciplined—remember that consistency, not speed, creates results.Conclusion👌 So simple, so clever: 20 best Dave Ramsey tips done right! shows that financial success isn’t about being flashy or complicated. It’s about sticking to basic, timeless principles: live within your means, avoid debt, save for emergencies, and build wealth intentionally. Whether you’re starting at step one with your first emergency fund or investing for retirement, these strategies can transform your financial future.👉 The big takeaway? Money management is simple—but not always easy. Follow these steps, stay disciplined, and you’ll be on your way to financial peace. 💰✨