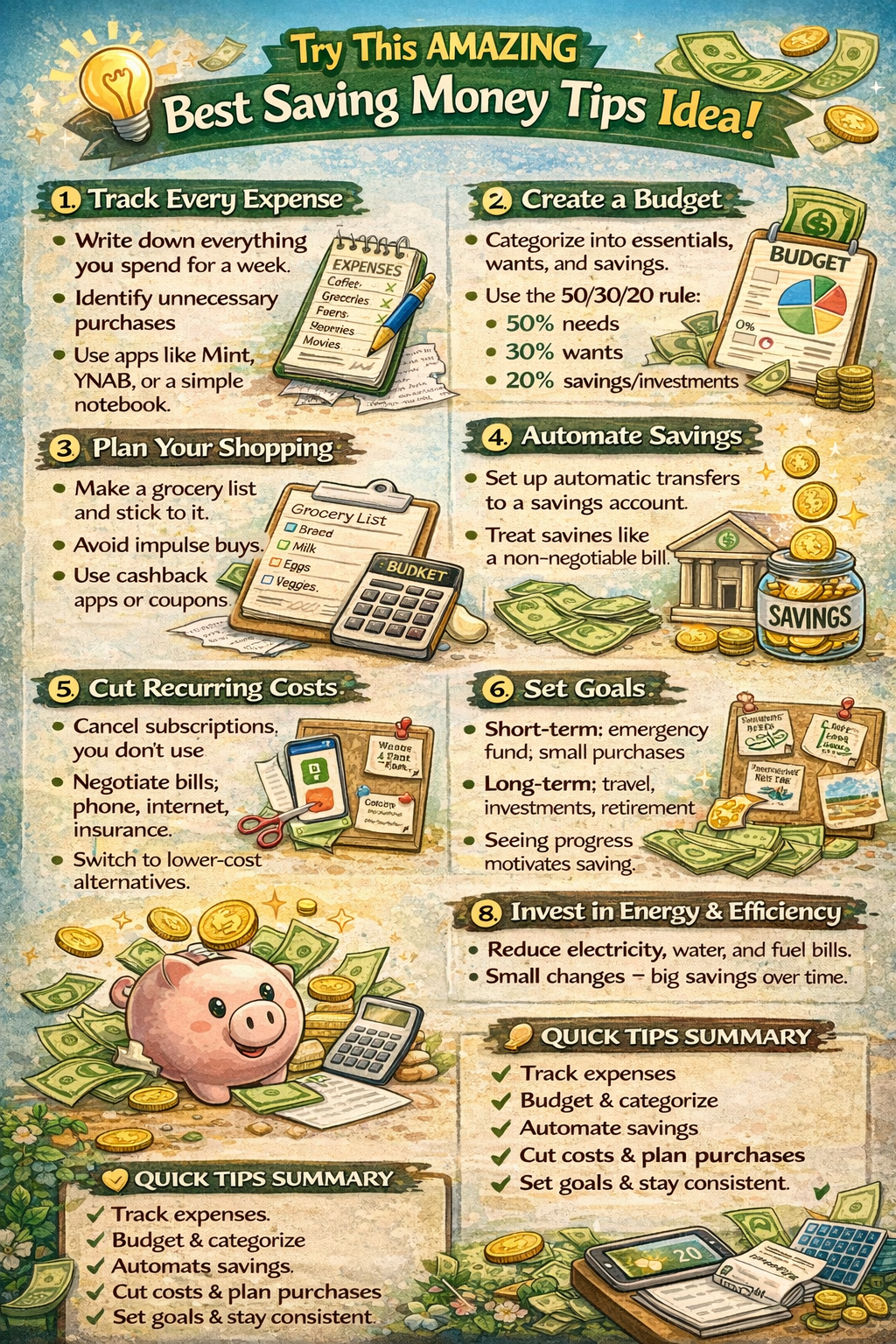

Saving money doesn’t have to be complicated or restrictive. Whether you’re a student, a working professional, or managing a household, smart strategies can help you build a financial cushion, pay off debt, or achieve your goals faster. Try this amazing best saving money tips idea!—it’s designed to be simple, practical, and effective for anyone in the United States, United Kingdom, or Canada.This guide will walk you through proven techniques, practical habits, and creative ideas that help you save consistently, without feeling like you’re depriving yourself. By applying these strategies, you can transform your finances and gain peace of mind.Why Saving Money is ImportantFinancial security: Build an emergency fund for unexpected expenses.Achieve goals: Save for vacations, homeownership, or education.Reduce stress: Financial stability lowers anxiety about bills and debt.Empowerment: Saving gives you control over your financial future.With the right approach, saving becomes a habit rather than a chore.Practical Tips to Save Money Every Month1. Track Your SpendingRecord every expense for at least a month.Use apps, spreadsheets, or even a simple notebook.Identify areas where you can cut back without sacrificing essentials.Tracking spending is the first step in any effective saving plan.2. Set Realistic Savings GoalsShort-term: Emergency fund, monthly budget cushion.Medium-term: Vacation, new gadget, or home renovation.Long-term: Retirement, mortgage down payment, or investments.Having clear goals motivates you to stick to your plan.3. Automate Your SavingsSet up automatic transfers to a savings account.Treat savings like a non-negotiable monthly bill.Consider high-yield savings accounts to maximize interest.Automation ensures consistent saving without constant effort.4. Reduce Unnecessary SubscriptionsReview streaming services, gym memberships, and apps.Cancel or pause services you rarely use.Share subscriptions with family or friends when possible.Even small monthly savings add up over time.5. Meal Planning and Smart Grocery ShoppingPlan meals for the week to avoid impulsive purchases.Buy in bulk for staples like rice, pasta, or frozen vegetables.Use coupons, discount apps, or loyalty programs.Cutting food waste and shopping strategically can save a surprising amount.6. Cut Energy and Utility CostsSwitch to energy-efficient lighting and appliances.Adjust thermostat settings and unplug unused electronics.Compare utility providers to find better rates.These changes reduce bills while helping the environment.7. Avoid Impulse PurchasesImplement a 24-hour rule before buying non-essential items.Make a shopping list and stick to it.Limit window shopping or online browsing.Mindful spending prevents unnecessary financial leaks.Creative Saving Money IdeasDIY and upcycling: Repair or repurpose items instead of buying new.Second-hand shopping: Thrift stores, online marketplaces, and garage sales.Cash-back and reward programs: Earn money back on everyday purchases.Side hustles: Use spare time to generate extra income.These strategies complement standard saving habits and accelerate progress.Building Long-Term Financial HabitsReview your budget monthly and adjust as needed.Celebrate milestones to stay motivated.Avoid lifestyle inflation—don’t increase spending when income rises.Educate yourself about investing, retirement accounts, and financial planning.Long-term habits turn short-term saving tips into lifelong financial health.Common Mistakes to AvoidSkipping small savings: Every dollar counts.Neglecting an emergency fund: Unexpected expenses can derail plans.Ignoring debt: High-interest debt reduces your ability to save.Relying solely on willpower: Automated savings prevent overspending.Avoiding these pitfalls ensures consistent progress.Why This Works in the US, UK, and CanadaStrategies apply to common financial systems in all three countries.Tools like apps, bank accounts, and loyalty programs are widely accessible.Tips accommodate varying income levels, currencies, and living costs.No matter where you live, you can implement these techniques and see results.ConclusionFinancial security and freedom start with smart habits and intentional choices. By implementing these strategies, you can try this amazing best saving money tips idea! to reduce expenses, grow your savings, and reach your goals faster.Start with small changes—track your spending, automate savings, and cut unnecessary costs—and watch how quickly your financial situation improves. With patience, consistency, and creativity, saving money can become not just achievable, but empowering. 💰✨