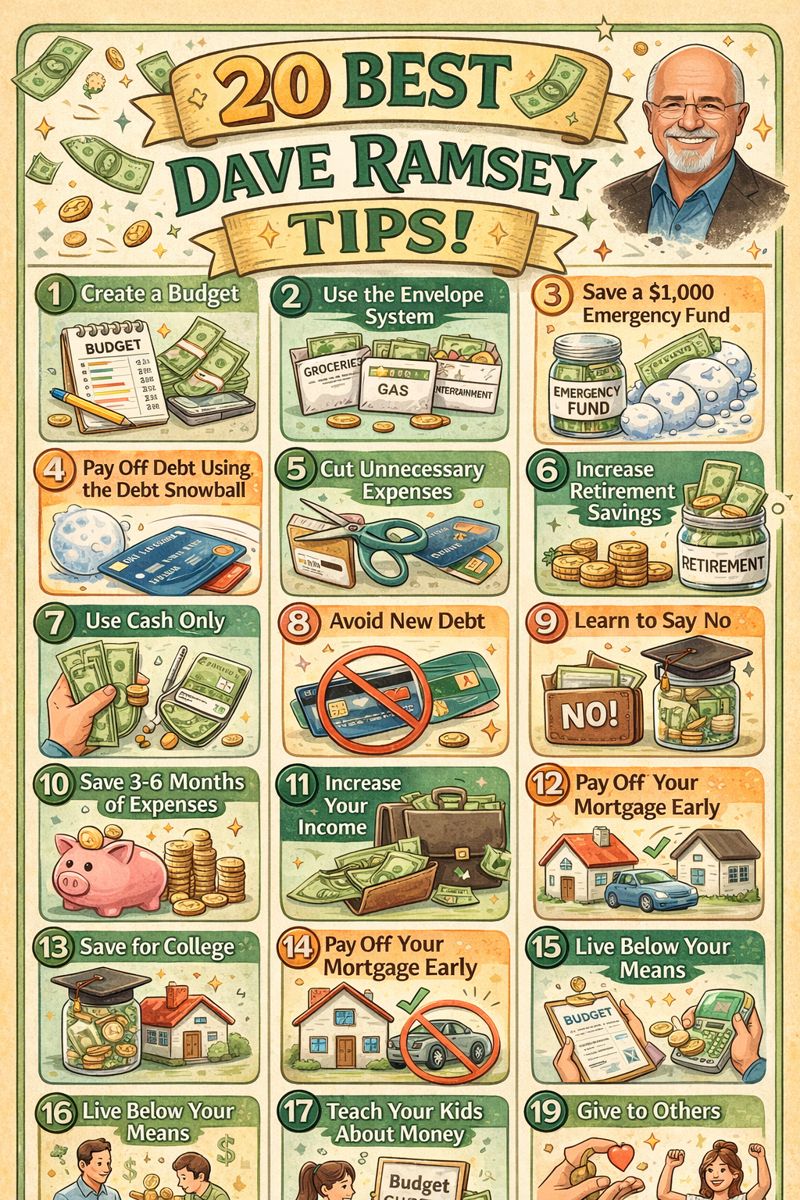

# Make it easy: 20 Best Dave Ramsey Tips!## IntroductionManaging money doesn’t have to feel confusing, stressful, or overwhelming. Many people across the United States, United Kingdom, and Canada struggle with debt, budgeting, and saving—not because they lack income, but because they lack a clear plan. That’s where Dave Ramsey’s financial philosophy stands out.This article, **“Make it easy: 20 best Dave Ramsey tips!”**, breaks down his most effective and practical money principles in a simple, easy-to-follow way. Dave Ramsey is known for his straightforward advice, common-sense rules, and focus on long-term financial peace. Whether you’re just starting your financial journey or trying to regain control of your money, these tips can help you build confidence and stability.Let’s make it easy.—## Who Is Dave Ramsey and Why His Advice WorksDave Ramsey is a personal finance expert, author, and radio host best known for his **Baby Steps** approach to money management. His advice works because it is:* Simple and clear* Behavior-focused, not math-focused* Designed for real-life situations* Proven by millions of peopleThe goal is not just wealth—but **financial peace**.—## Make it easy: 20 Best Dave Ramsey Tips!### 1. Start With a Written BudgetA budget tells your money where to go instead of wondering where it went. Dave Ramsey strongly believes that **every dollar needs an assignment**.**Tip:** Use zero-based budgeting so your income minus expenses equals zero.—### 2. Build a Starter Emergency FundBefore paying off debt aggressively, save **$1,000** as a beginner emergency fund.**Why it matters:** This prevents small emergencies from turning into new debt.—### 3. Use the Debt Snowball MethodList your debts from smallest to largest balance and pay them off in that order.**Key benefit:** Quick wins create motivation and momentum.—### 4. Stop Using Credit CardsDave Ramsey advises cutting up credit cards completely.**Reason:** Credit cards encourage overspending and keep people trapped in debt cycles.—### 5. Live on Less Than You MakeThis may sound obvious, but it’s powerful.**Core principle:** Wealth is built by margin—spending less than you earn and saving the difference.—### 6. Save 3–6 Months of ExpensesOnce debt-free (except your home), build a fully funded emergency fund covering **three to six months of expenses**.**Result:** Financial security and peace of mind.—### 7. Pay Cash Whenever PossibleCash makes spending more intentional and painful—in a good way.**Pro tip:** People spend less when using cash instead of cards.—### 8. Avoid Lifestyle InflationAs income increases, don’t rush to upgrade your lifestyle.**Dave Ramsey rule:** Just because you can afford something doesn’t mean you should buy it.—### 9. Buy Reliable Used CarsCars are depreciating assets. Dave Ramsey recommends buying used vehicles with cash.**Guideline:** The total value of vehicles should not exceed 50% of your annual income.—### 10. Invest 15% of Your Income for RetirementAfter becoming debt-free, invest **15% of your household income** into retirement accounts.**Focus:** Long-term growth using mutual funds or diversified investments.—### 11. Understand the Difference Between Needs and WantsLearning to delay gratification is key to financial success.**Ask yourself:** “Do I need this, or do I just want it right now?”—### 12. Don’t Try to Keep Up With OthersComparison is one of the biggest financial traps.**Truth:** Most people are broke trying to look rich.—### 13. Give GenerouslyDave Ramsey emphasizes generosity as part of financial health.**Why it matters:** Giving keeps money from controlling your life.—### 14. Teach Your Kids About Money EarlyChildren who learn money skills early are better prepared for adulthood.**Simple ideas:** Allowances, saving jars, and basic budgeting lessons.—### 15. Avoid Get-Rich-Quick SchemesIf it sounds too good to be true, it probably is.**Dave’s advice:** Build wealth slowly and consistently.—### 16. Make Saving AutomaticAutomate savings and investments so consistency becomes effortless.**Result:** Less temptation to spend and more long-term progress.—### 17. Pay Off Your Home Early (If Possible)Being mortgage-free is a major step toward financial peace.**Benefit:** No house payment means more freedom and security.—### 18. Focus on Behavior, Not Just NumbersMoney problems are often behavior problems.**Key insight:** Changing habits matters more than knowing formulas.—### 19. Stay Intense—but Not ForeverDave Ramsey encourages being “gazelle intense” when getting out of debt.**Good news:** The sacrifice is temporary, but the benefits are long-term.—### 20. Financial Peace Is the Real GoalThe ultimate purpose of money is not status or stuff—it’s peace.**Core message:** Money should serve you, not control you.—## Practical Tips to Apply Dave Ramsey’s Advice TodayHere’s how to make these principles easier to implement:* Track expenses weekly, not monthly* Start small to avoid burnout* Celebrate milestones (debt paid off, savings goals reached)* Involve your family in financial decisions* Stay consistent, even when progress feels slowRemember, consistency beats perfection.—## Common Mistakes to AvoidEven when following **“Make it easy: 20 best Dave Ramsey tips!”**, people sometimes struggle. Avoid these pitfalls:* Trying to do everything at once* Ignoring small expenses* Giving up after setbacks* Relying on credit during emergencies* Skipping the budgetProgress comes from persistence, not perfection.—## Why Dave Ramsey’s Tips Work Across the US, UK, and CanadaAlthough Dave Ramsey is based in the US, his principles apply globally because they focus on behavior, not specific financial products. Budgeting, saving, avoiding debt, and living below your means are universal financial truths.No matter where you live, these tips help simplify money decisions and reduce financial stress.—## ConclusionMoney doesn’t have to be complicated. With the right mindset and a clear plan, anyone can take control of their finances. This guide, **“Make it easy: 20 best Dave Ramsey tips!”**, shows that financial success comes from simple habits practiced consistently over time.By budgeting, eliminating debt, saving intentionally, and focusing on long-term goals, you can move from stress to stability—and eventually, to financial peace. Start with one step today. Small actions, repeated daily, can completely change your financial future.Make it easy. Make it intentional. And take control of your money—once and for all.