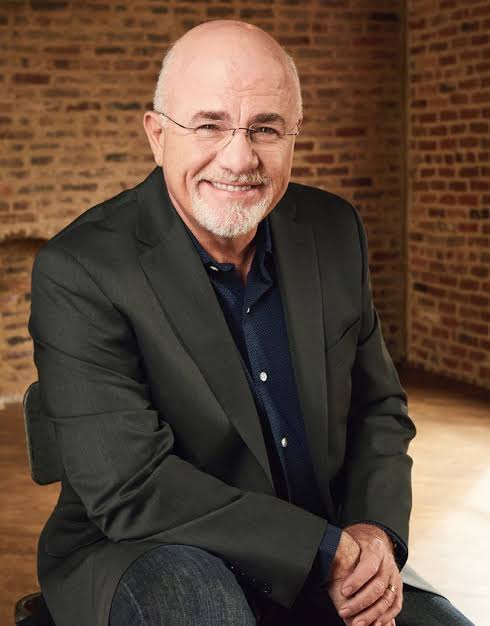

Simple, Actionable Advice to Take Control of Your Money and Build WealthIf you’ve ever felt overwhelmed by debt, confused about budgeting, or unsure how to start saving, you’re not alone. Personal finance can feel complicated — but it doesn’t have to be. That’s where financial expert Dave Ramsey comes in.Known for his no-nonsense approach to money management, Ramsey has helped millions of people across the United States, United Kingdom, and Canada take control of their finances through simple, practical strategies.In this article, “Make it easy: 20 best Dave Ramsey tips!”, we’ll break down his top money principles — from budgeting and saving to debt payoff and wealth building — so you can start improving your financial future today.💵 Why Listen to Dave Ramsey?Before we dive into the tips, let’s quickly understand why Dave Ramsey’s advice is so popular.Ramsey is a personal finance author, radio host, and creator of the Financial Peace University program. His approach is based on discipline, simple math, and behavior change — not get-rich-quick schemes.His philosophy:“You can’t out-earn bad financial habits. Fix the behavior, and the money will follow.”If you want practical, proven steps that actually work in real life, these 20 best Dave Ramsey tips are your perfect starting point.🪙 1. Create a Zero-Based BudgetOne of Ramsey’s core principles is the zero-based budget — giving every dollar a purpose before the month begins.You simply list your income, subtract all expenses (including savings and debt payments), and ensure the balance equals zero.✅ Pro Tip: Use budgeting apps like EveryDollar (created by Ramsey Solutions) to make this process easy.💳 2. Stop Using Credit CardsDave Ramsey strongly believes credit cards create debt traps. Instead, he recommends using cash or a debit card.He says:“If you can’t pay for it with cash, you can’t afford it.”This helps you avoid interest charges and live within your means.💰 3. Build a Starter Emergency Fund ($1,000)Before tackling debt, Ramsey suggests saving $1,000 as a quick emergency fund.This protects you from relying on credit cards for unexpected expenses like car repairs or medical bills.Think of it as your financial safety cushion.🧾 4. Follow the 7 Baby StepsThe 7 Baby Steps are the foundation of Ramsey’s system. They’re small, simple actions that lead to financial freedom:Save $1,000 for emergencies.Pay off all debt (except your house) using the debt snowball.Save 3–6 months of expenses.Invest 15% of your income for retirement.Save for your kids’ college.Pay off your home early.Build wealth and give generously.Each step builds momentum toward lasting success.📉 5. Use the Debt Snowball MethodRamsey’s Debt Snowball Method is one of his most famous tips.List all your debts from smallest to largest. Pay off the smallest first while making minimum payments on the rest. Once one debt is gone, roll that payment into the next one.It’s all about motivation — small wins keep you going!🏦 6. Save a Fully Funded Emergency FundAfter paying off debt, Ramsey recommends saving 3 to 6 months of expenses in a high-yield savings account.This gives you peace of mind in case of job loss, medical emergencies, or major life changes.📊 7. Invest 15% of Your IncomeOnce your finances are stable, invest 15% of your household income into retirement accounts like:401(k) (especially if your employer matches)Roth IRA or Traditional IRA (depending on your tax situation)Invest consistently, not emotionally. Ramsey reminds people that slow and steady wins the race.🏡 8. Pay Off Your Home EarlyWhile many see mortgages as “good debt,” Ramsey encourages paying them off as soon as possible.He says,“Imagine your life with no house payment — that’s when true financial freedom begins.”Even an extra payment or two per year can shave years off your loan.💸 9. Live Below Your MeansThis simple truth underpins all of Ramsey’s teachings.Stop comparing yourself to others. Spend less than you earn, avoid lifestyle inflation, and prioritize savings over status.It’s not about deprivation — it’s about control.🧮 10. Track Every DollarRamsey emphasizes that you can’t manage what you don’t measure.Track every expense, no matter how small. It builds awareness and prevents impulse spending.Tools like EveryDollar or even a simple spreadsheet can help you see where your money really goes.💳 11. Cut Up Your Credit CardsOne of Dave’s most iconic moves — literally cutting up your credit cards — is symbolic of taking back control.It’s not about fear; it’s about freedom. Without credit card debt, you keep your money instead of giving it to the bank.🧠 12. Stop Leasing CarsAccording to Ramsey, car leases are the biggest wealth killer for middle-class families.“A car lease is just paying to borrow something that loses value.”Instead, save and buy a used, reliable car with cash.💵 13. Practice the Envelope SystemIf you struggle with overspending, Ramsey suggests using cash envelopes.Label envelopes for categories like groceries, dining, and gas. Once the cash is gone, that’s it for the month.It’s a simple way to stay accountable.👨👩👧 14. Teach Kids About Money EarlyFinancial literacy starts young. Ramsey encourages parents to involve kids in budgeting and saving.Teach them the Earn → Save → Spend → Give method early — it’s a lifelong skill.📈 15. Avoid Debt at All CostsRamsey’s mantra is clear: Debt is not a tool; it’s a trap.From student loans to credit cards, he believes borrowing money delays financial peace.Instead, pay cash whenever possible and avoid debt like the plague.🎯 16. Set Financial GoalsA budget without a goal is just a list.Set short-term goals (like paying off a credit card) and long-term goals (like buying a home or retiring early).Ramsey believes clarity creates motivation.💝 17. Give GenerouslyGenerosity is a key part of Dave Ramsey’s philosophy.Once you’ve achieved financial stability, give back — whether through donations, church tithing, or helping loved ones.Giving brings joy, gratitude, and perspective.📚 18. Keep Learning About MoneyRamsey often says,“Personal finance is 80% behavior and 20% head knowledge.”Keep reading books, listening to podcasts, and staying inspired. His own titles — like The Total Money Makeover and Baby Steps Millionaires — are great places to start.🔁 19. Stick With It (Consistency Matters)Change doesn’t happen overnight.It takes months or even years to pay off debt, save, and invest.Ramsey reminds people that consistency beats intensity. Keep making small, smart choices daily — they compound over time.💡 20. Celebrate Financial MilestonesFinally, don’t forget to celebrate your progress!Paid off a loan? Treat yourself (responsibly). Built an emergency fund? Acknowledge your effort.Ramsey’s approach isn’t about punishment — it’s about empowerment.📘 Bonus: The Mindset ShiftIf there’s one lesson to take from “Make it easy: 20 best Dave Ramsey tips!”, it’s this: financial success starts with mindset.You don’t need to earn six figures to build wealth — you just need discipline, patience, and a plan.Ramsey’s message resonates because it’s built on timeless truths:Live on less than you make.Stay out of debt.Save and invest wisely.Be generous.Simple, right? But life-changing when applied consistently.✅ Conclusion: Take Control of Your Money TodayThere you have it — Make it easy: 20 best Dave Ramsey tips! These principles are straightforward, practical, and proven to work.Start with one or two steps today. Maybe it’s setting a budget, cutting up a credit card, or saving your first $1,000.Each small win builds momentum.Remember: financial freedom isn’t about luck — it’s about discipline and direction.So take control, follow these steps, and watch your financial confidence grow. Because as Dave Ramsey says,“If you live like no one else now, later you can live like no one else.”