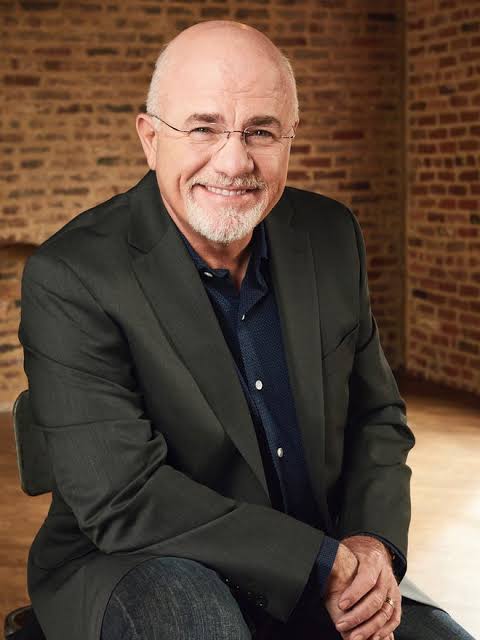

When it comes to financial freedom, few names are as recognized as Dave Ramsey. From his bestselling book The Total Money Makeover to his popular Ramsey Show, he’s helped millions escape debt, build wealth, and achieve lasting peace of mind.So, whether you’re just starting your financial journey or looking to sharpen your money habits, these 20 Dave Ramsey tips are packed with practical wisdom and timeless advice.Let’s dive in — because your financial magic awaits! 💫🪙 1. Follow the 7 Baby StepsDave Ramsey’s legendary 7 Baby Steps are the backbone of his program.1️⃣ Save $1,000 for a starter emergency fund2️⃣ Pay off all debt (except the house) using the Debt Snowball3️⃣ Build a fully funded emergency fund (3–6 months of expenses)4️⃣ Invest 15% of your income in retirement accounts5️⃣ Save for your kids’ college fund6️⃣ Pay off your home early7️⃣ Build wealth and give generously💡 Magic Awaits Hack: Print these steps and keep them where you’ll see them daily — it keeps your goals front and center!💳 2. Ditch the Credit CardsRamsey is famous for saying, “You don’t need a credit score — you need cash!” He encourages people to cut up their credit cards and stop relying on debt.🧠 Pro Tip: Use a debit card or cash envelope system instead to stay disciplined.💰 3. Create a Monthly Zero-Based BudgetEvery dollar should have a purpose. With a zero-based budget, you assign every dollar of income to a category — bills, savings, fun, etc. — until nothing is left “floating.”✨ Magic Awaits Tip: Try using Ramsey’s free EveryDollar app to make budgeting simple and automatic.🏦 4. Build a Small Emergency Fund — FastLife happens. Dave’s first rule is to save $1,000 quickly, so emergencies don’t push you further into debt.🔑 Hack: Sell unused items, pause subscriptions, or take a weekend side hustle to hit that goal in weeks, not months.💥 5. Use the Debt Snowball MethodList all your debts from smallest to largest. Pay minimums on everything except the smallest — throw all extra money there until it’s gone. Then move on to the next.💣 Motivation Hack: The quick wins keep your momentum high, and you’ll see progress fast!🧾 6. Track Every ExpenseKnowledge is power. Knowing where every penny goes helps you stop wasteful spending and spot opportunities to save.💡 Magic Awaits Tip: Review your spending at the end of each week — it’s like a “money check-in” for your goals.💡 7. Stop Leasing CarsAccording to Dave, leasing is just “fleecing.” You’re essentially paying to borrow a depreciating asset.🚗 Smart Move: Buy reliable used cars with cash instead — and let your money grow, not your car payments.🏠 8. Don’t Buy a House Too SoonDave Ramsey recommends buying a home only when you’re debt-free and have a full emergency fund, plus a 20% down payment.🏡 Magic Awaits Hack: If you can’t afford a 15-year fixed-rate mortgage, it’s not time to buy — yet.📉 9. Avoid Borrowing for CollegeStudent loan debt can haunt you for years. Ramsey advises saving in advance with a 529 plan and encouraging students to work part-time or choose affordable schools.🎓 Real Talk: A debt-free degree is worth far more than a fancy school name.💼 10. Live Below Your MeansIt’s simple but powerful — spend less than you earn. The gap between income and expenses is where wealth grows.💰 Magic Awaits Hack: Every time you get a raise, save or invest 50% of it before increasing your lifestyle.🧘 11. Focus on ContentmentFinancial peace starts with contentment, not comparison. Ramsey reminds followers to stop keeping up with the Joneses — they’re probably broke anyway!🌿 Tip: Practice gratitude daily — it’s the best financial stress reliever.💳 12. Cut the Cord on Credit ScoresYour credit score measures how well you manage debt, not wealth. Ramsey argues you can live credit-free — with cash, debit, and a strong financial plan.🪙 Magic Awaits Insight: A paid-for house and fat savings account beat an 800 credit score any day.💡 13. Pay Cash for Big PurchasesFrom furniture to vacations, Ramsey suggests saving up and paying cash. No interest, no payments, just peace of mind.💫 Tip: Keep a “sinking fund” — a small savings account for predictable big expenses.💵 14. Invest in Retirement EarlyOnce you’ve paid off your debt, start investing 15% of your household income in Roth IRAs and 401(k)s.🧮 Magic Awaits Hack: Automate your retirement contributions so you never forget or skip them.🧒 15. Teach Kids About Money EarlyRamsey believes money lessons should start at home. Give kids commissions for chores, not allowances — it builds work ethic and financial awareness.👶 Family Hack: Have “money nights” with your kids to set goals and talk about saving.💕 16. Give GenerouslyGenerosity is at the heart of Ramsey’s philosophy. Once you’re financially free, you can give with joy and without guilt.💝 Magic Awaits Tip: Build giving into your budget — even a small portion can make a huge impact.🧭 17. Stop the ExcusesDave Ramsey says, “You can make progress or make excuses, but not both.” Take ownership of your financial life — no one’s coming to rescue you.💪 Mindset Hack: Start small, stay consistent, and you’ll see results faster than you think.💳 18. Avoid Co-Signing LoansRamsey’s rule: Never co-sign, not even for family. You’ll be responsible if they default — and it can wreck relationships and credit.🚫 Magic Awaits Rule: Help with wisdom, not wallets.🧠 19. Keep Learning About MoneyThe more you learn, the more you earn. Listen to The Ramsey Show, read Financial Peace Revisited, or attend a Financial Peace University course.📚 Hack: Make personal finance part of your daily routine — even 10 minutes a day can change your money mindset.🌈 20. Build Wealth to Change LivesDave Ramsey’s ultimate message isn’t just about money — it’s about freedom and purpose. Build wealth so you can live fully, bless others, and create lasting change.💫 Final Magic: Wealth isn’t evil — it’s a tool for good when you use it wisely.🪄 Conclusion: Financial Freedom — Magic Awaits!These 20 Dave Ramsey tips aren’t just financial strategies — they’re life-changing principles. By budgeting, avoiding debt, and focusing on long-term goals, you can move from surviving to thriving.Remember: you don’t have to be rich to start — you just have to start to become rich.💥 Take control, follow the steps, and watch your financial confidence grow — because with these Ramsey-inspired hacks, your money magic truly awaits! 🌟SEO Keywords:Dave Ramsey tips, money-saving hacks, financial freedom guide, budgeting tips, debt snowball method, how to save money, zero-based budgeting, build wealth fast, money management for beginners